Stay compliant. Stay confident.

Our Legal and Tax Compliance service ensures that your business meets all regulatory requirements while avoiding costly penalties, missed filings, and audit risks. We don’t just prepare your records—we proactively manage and maintain them to meet the exacting standards of federal, state, and local authorities.

1. Accurate Tax Preparation & Filing

- Income & Expense Categorization: We ensure every transaction is properly classified in your accounting system (e.g., QuickBooks®), so nothing is over- or under-reported.

- Sales Tax Tracking & Filing: Monitor, calculate, and file sales taxes across jurisdictions with accurate nexus reporting.

- Federal, State & Local Tax Returns: Timely preparation and e-filing of all business tax returns, including:

- Schedule C (for sole proprietors)

- 1120S (for S Corporations)

- 1065 (for Partnerships)

- 941/940 Payroll Tax Filings

- Estimated Tax Planning: Quarterly estimate reminders and calculations so you’re never caught off guard.

2. IRS & State Compliance

- Audit-Ready Bookkeeping: Clean, well-documented financial records with supporting documentation (receipts, invoices, reconciliations) stored securely and ready for review.

- 1099/Contractor Compliance: Preparation, filing, and TIN matching for 1099-NEC and 1099-MISC forms—keeping you compliant with IRS requirements for independent contractors.

- Entity Compliance Support: Ensure your LLC, S Corp, or Corporation remains in good standing with:

- Annual report filings

- Business license renewals

- Registered agent coordination

3. Proactive Risk Management

- Compliance Calendar: A customized filing calendar with automated reminders for tax deadlines, license renewals, and reporting obligations.

- Document Retention & Storage: Secure, cloud-based storage of financial records for IRS-required retention periods (typically 3–7 years).

- Policy & Process Reviews: Periodic reviews to identify compliance gaps and recommend improvements in internal controls and financial practices.

4. Payroll Tax Compliance

- Withholding Accuracy: Ensure proper withholding for federal, state, and local taxes (including Social Security, Medicare, FUTA, and SUTA).

- W-2 and 1099 Reporting: Year-end preparation and electronic filing for all employee and contractor wage forms.

- Unemployment and Workers’ Comp Reporting: Help you stay compliant with state-level employment reporting and insurance filings.

5. Representation & Support

- Tax Notice Response: We handle IRS or state tax letters and correspondence, reducing your stress and ensuring a timely, professional response.

- CPA Coordination: We work seamlessly with your CPA or tax attorney—or bring in our partners if you don’t have one.

Engagement Packages

| Plan | Ideal For | Tax Filings Included | Audit Support | Starting Price* |

|---|---|---|---|---|

| Compliance Essentials | Solopreneurs & contractors | 1099, Schedule C | ✔ Audit-Ready Books | $*** /mo |

| Business Core | LLCs & S Corps | Income, payroll, sales tax | ✔ Plus IRS correspondence | $*** /mo |

| Growth & Risk | Multi-state or regulated industries | All federal & state | ✔✔ Full Audit Liaison | Quote |

*Final pricing based on entity structure, filing complexity, and transaction volume.

The Bottom Line

We make compliance a strength—not a burden. With our Legal and Tax Compliance service, your business will always be on time, on target, and audit-ready. Say goodbye to late fees, missed deadlines, and tax season panic—and say hello to peace of mind.

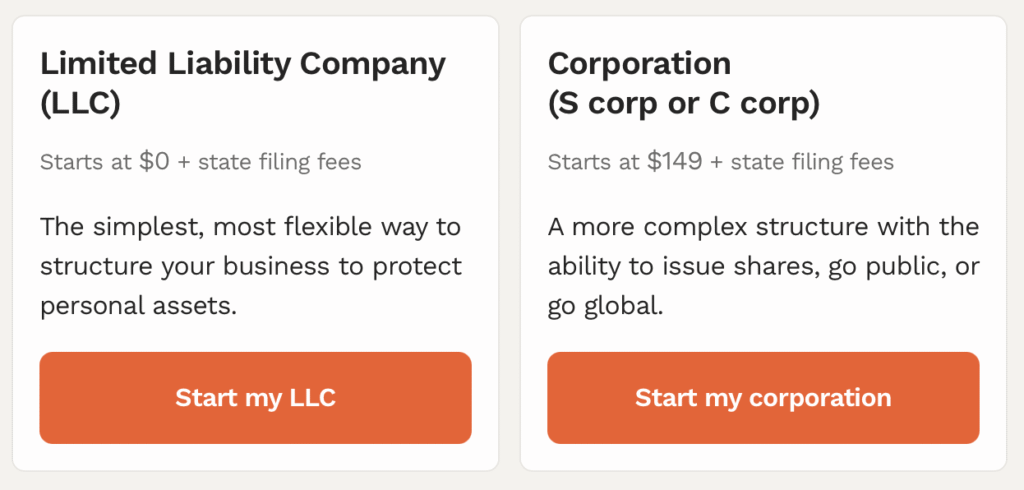

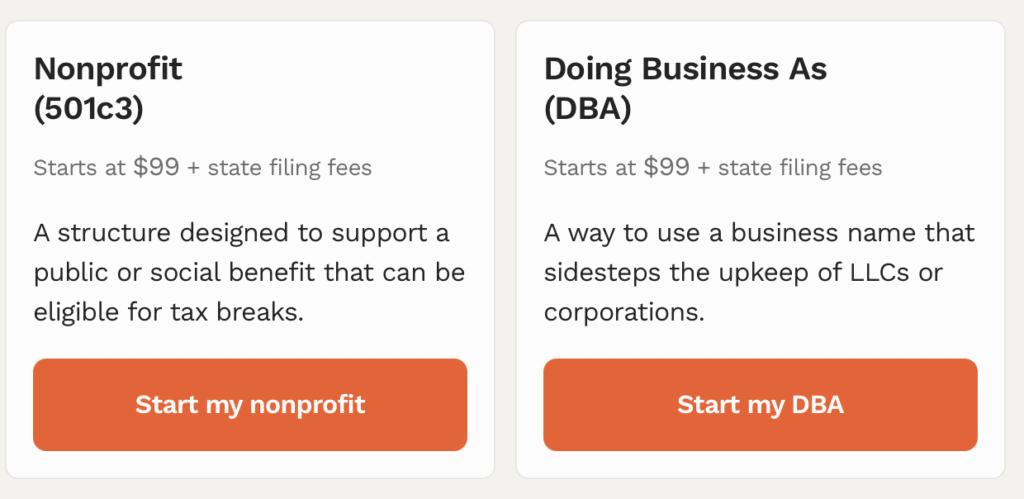

Incorporate your business with us.

Introduction: The Critical Decision Every Business Owner Faces

Starting a business is exhilarating, but operating without proper legal structure is like driving without insurance—everything seems fine until something goes wrong. For most small business owners, forming a Limited Liability Company (LLC) represents one of the most important decisions they’ll make. This guide explains why an LLC isn’t just legal paperwork—it’s essential protection for your personal assets, professional credibility, and business future.

The Fundamental Protection: Personal Asset Shield

Understanding Personal Liability Without an LLC

When you operate as a sole proprietor or general partnership, you and your business are legally the same entity. This means:

- Business debts become personal debts

- Lawsuits against your business can target personal assets

- Creditors can pursue your home, car, and savings

- One business mistake could cost you everything

Real-World Example: A freelance web developer operating as a sole proprietor accidentally causes a client’s e-commerce site to crash during Black Friday. The client sues for $500,000 in lost sales. Without an LLC, the developer’s personal savings, home equity, and future earnings are all at risk.

How LLC Protection Works

An LLC creates a legal separation between you and your business:

- The LLC owns business assets and debts

- You own the LLC, not the business directly

- Creditors can only pursue LLC assets

- Your personal assets remain protected

The Same Example With LLC Protection: The web developer with an LLC faces the same lawsuit, but only the LLC’s assets (business bank accounts, equipment, receivables) are at risk. Their personal home and savings remain protected.

Exceptions to LLC Protection

LLC protection isn’t absolute. You can still be personally liable for:

- Personal guarantees on business loans

- Intentional wrongdoing or fraud

- Commingling personal and business funds

- Failing to maintain LLC formalities

- Professional malpractice (in some cases)

Tax Advantages and Flexibility

Pass-Through Taxation Benefits

LLCs offer unique tax flexibility:

- Default Pass-Through Status: Profits and losses flow to personal tax returns

- Avoid Double Taxation: Unlike C-corporations, no corporate tax level

- Deduction Opportunities: Qualify for Section 199A deduction (up to 20% of business income)

- Loss Benefits: Business losses can offset other income

Tax Election Options

LLCs can choose how they’re taxed:

- Sole Proprietorship (single-member default)

- Partnership (multi-member default)

- S-Corporation (can reduce self-employment taxes)

- C-Corporation (rare but available)

Example Tax Savings: An LLC earning $100,000 electing S-Corp status might save $5,000-$7,000 annually in self-employment taxes.

State Tax Considerations

Some states offer additional LLC tax benefits:

- No state income tax in certain states

- Lower franchise fees than corporations

- Simplified tax filing requirements

- Pass-through entity tax elections

Professional Credibility and Business Operations

Enhanced Business Credibility

An LLC immediately elevates your professional status:

- Appears more established to clients

- Required by many corporate clients

- Easier to obtain business credit

- Professional appearance in contracts

Client Perception: “Jane Smith” vs. “JS Consulting, LLC” – which would you trust with your important project?

Operational Advantages

LLCs provide practical business benefits:

- Business Bank Accounts: Required for true asset protection

- Merchant Services: Better rates and terms

- Business Credit: Build credit separate from personal

- Vendor Accounts: Access wholesale and net terms

- Insurance: Business liability policies available

Contract and Legal Benefits

Operating as an LLC:

- Sign contracts as the business entity

- Limit liability in business agreements

- Professional indemnification clauses

- Clear business succession planning

Access to Funding and Investment

Traditional Lending

Banks and lenders prefer working with LLCs:

- Established business structure

- Separate financial statements

- Clear ownership structure

- Professional documentation

Investment Opportunities

LLCs can:

- Issue membership interests

- Bring in investors easily

- Create different classes of ownership

- Maintain management control

Government Programs

Many programs require formal business structure:

- SBA loans and programs

- Government contracts

- Grant eligibility

- COVID relief programs (PPP, EIDL)

Operational Flexibility and Management

Management Structure Options

LLCs offer flexibility in management:

- Member-Managed: All owners participate

- Manager-Managed: Designated managers run operations

- Hybrid Structures: Customized arrangements

Operating Agreement Freedom

Unlike corporations, LLCs can customize:

- Profit distribution (not tied to ownership percentage)

- Voting rights and decision-making

- Member responsibilities

- Exit strategies and buyout terms

Simplified Compliance

Compared to corporations, LLCs have:

- No board of directors requirement

- No annual meeting mandates

- Fewer reporting requirements

- Simplified record-keeping

Business Continuity and Growth

Succession Planning

LLCs facilitate business continuity:

- Clear ownership transfer mechanisms

- Business survives owner changes

- Estate planning integration

- Buy-sell agreements

Scalability Benefits

LLCs can grow with your business:

- Add members easily

- Convert to corporation if needed

- Expand to multiple states

- Create subsidiary LLCs

Exit Strategy Options

Multiple exit paths available:

- Sell membership interests

- Merge with other entities

- Convert to different structure

- Orderly dissolution process

Industry-Specific Considerations

High-Risk Industries

Essential for businesses with liability exposure:

- Construction and contractors

- Consulting and professional services

- Real estate investment

- Food service and hospitality

- E-commerce and online services

Professional Services

Special considerations for:

- May need Professional LLC (PLLC)

- Malpractice insurance still required

- State-specific regulations

- Enhanced credibility crucial

Real Estate

LLCs are ideal for:

- Rental property ownership

- Fix-and-flip investments

- Property management

- Real estate development

Common Misconceptions Debunked

“LLCs Are Too Expensive”

Reality Check:

- State fees: $50-$500 (one-time)

- Annual fees: $0-$800

- Compare to: One lawsuit could cost everything

“LLCs Are Too Complicated”

Truth:

- Formation can take 1-2 hours online

- Simple annual requirements

- Many resources available

- Professional help affordable

“I’m Too Small for an LLC”

Consider This:

- Risk exists regardless of size

- Credibility matters from day one

- Easier to start right than fix later

- Growth happens faster than expected

“My Business Has No Risk”

Every Business Has Risk:

- Data breaches and privacy claims

- Intellectual property disputes

- Contract disagreements

- Employee-related claims

- Premises liability

Step-by-Step LLC Formation Overview

1. Choose Your State

- Usually your home state

- Consider Delaware/Nevada for specific benefits

- Factor in fees and taxes

2. Name Your LLC

- Check availability

- Include “LLC” in name

- Consider trademark search

- Reserve name if needed

3. Appoint Registered Agent

- Required in all states

- Receives legal documents

- Must have state address

- Can use service provider

4. File Articles of Organization

- Basic formation document

- Filed with state

- Includes key information

- Pays state fee

5. Create Operating Agreement

- Internal rules document

- Not filed with state

- Crucial for protection

- Defines member rights

6. Obtain EIN

- Federal tax ID number

- Free from IRS

- Required for banking

- Needed for employees

7. Open Business Banking

- Separate accounts crucial

- Maintains liability protection

- Simplifies accounting

- Builds business credit

Maintaining Your LLC Protection

Critical Ongoing Requirements

- Keep Finances Separate

- Dedicated business accounts

- No personal expenses

- Proper documentation

- Clear paper trail

- Maintain Corporate Formalities

- Annual state filings

- Updated operating agreement

- Meeting documentation

- Proper record-keeping

- Adequate Capitalization

- Sufficient business funds

- Appropriate insurance

- Realistic operations

- No underfunding

- Proper Documentation

- Sign as LLC member/manager

- Use LLC name consistently

- Business correspondence

- Contract clarity

Cost-Benefit Analysis

Formation Costs (Typical)

- State filing fee: $100-$500

- Registered agent: $100-$300/year

- Operating agreement: $0-$500

- EIN: Free

- Total Initial: $200-$1,300

Annual Costs

- State annual fee: $0-$800

- Registered agent: $100-$300

- Tax preparation: $500-$2,000

- Total Annual: $600-$3,100

Potential Savings

- Lawsuit protection: Unlimited

- Tax savings: $1,000-$10,000+/year

- Business deductions: Varies

- Credibility value: Immeasurable

Special Situations and Considerations

Single-Member LLCs

- Same liability protection

- Simplified taxes (usually)

- Easier management

- Consider S-Corp election

Multi-Member LLCs

- Partnership taxation default

- Operating agreement crucial

- Define roles clearly

- Plan for disputes

Converting Existing Business

- Usually straightforward

- Tax implications possible

- Timing considerations

- Professional guidance helpful

Multi-State Operations

- Foreign LLC registration

- Additional fees

- Registered agent needs

- Tax complexities

When NOT to Form an LLC

Limited Scenarios

- Certain licensed professionals (check state law)

- When C-Corporation better suits goals

- Minimal business activity

- Specific tax situations

Alternatives to Consider

- S-Corporation

- C-Corporation

- Limited Partnership

- Professional Corporation

Action Steps: Making It Happen

Immediate Actions (This Week)

- Research your state’s requirements

- Choose potential LLC names

- Calculate formation costs

- Identify registered agent options

Short-Term Actions (This Month)

- File formation documents

- Obtain EIN

- Draft operating agreement

- Open business accounts

Ongoing Actions

- Maintain separation of assets

- Keep proper records

- File annual reports

- Review and update as needed

Conclusion: The Cost of Waiting

Every day you operate without an LLC is a day of unnecessary risk. The cost of formation pales in comparison to losing personal assets in a lawsuit. Beyond protection, an LLC provides credibility, tax flexibility, and operational advantages that help your business grow.

The question isn’t whether you need an LLC—it’s whether you can afford to operate without one. For most small businesses, the answer is clear: forming an LLC is not just advisable, it’s essential.

Remember: This guide provides general information and shouldn’t substitute for professional legal and tax advice. Consult with qualified professionals to address your specific situation and ensure you’re making the best decision for your business.

Take Action Today

Your business deserves professional structure and protection. Your personal assets deserve separation from business risks. Your future deserves the flexibility and opportunities an LLC provides. Don’t wait for a problem to force the decision—form your LLC now and build your business on a solid legal foundation.